Get the free 10u form - ksrevenue

Show details

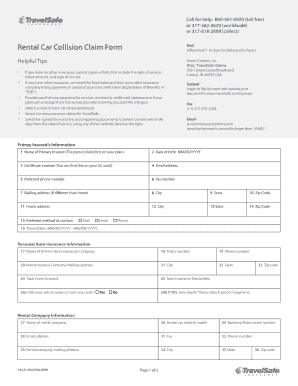

KANSAS Consumers Compensating Use Tax Return Form CT-10U Rev. 11/13 LINE 6 - Subtract line 5 from line 4 and enter the result on line 6. Phone 785-368-8222 Hearing Impaired TTY 785-296-6461 www. ksrevenue. org CT-10U Rev. 7/05 FOR OFFICE USE ONLY Kansas Consumers 432003 Business Name Tax Account Number Mailing Address EIN Due Date City State Zip Code MM Tax Period DD YY Period Beginning Date Date Business Closed Amended Return Additional Period E...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 10u form - ksrevenue

Edit your 10u form - ksrevenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 10u form - ksrevenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 10u form - ksrevenue online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 10u form - ksrevenue. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 10u form - ksrevenue

How to fill out form 10u?

01

First, gather all the necessary information and documents required to complete form 10u. This may include personal details such as name, address, date of birth, contact information, and social security number.

02

Read the instructions carefully to understand the purpose and requirements of form 10u. Familiarize yourself with the sections and questions on the form.

03

Begin filling out the form by providing your personal information in the designated fields. Make sure to enter accurate and up-to-date information to avoid any complications or delays.

04

Proceed to the next sections of the form, which may include questions regarding your employment status, income, dependents, and any deductions or credits you may be eligible for.

05

Double-check all the information you have entered for accuracy and completeness. It is essential to review your form thoroughly to ensure there are no errors or omissions.

06

If required, attach any supporting documents or evidence as instructed. This may include proof of income, receipts for deductions, or any other relevant documentation.

07

Once you have completed the form and attached any necessary documents, sign and date the form in the appropriate sections.

08

Make a copy of the completed form 10u and supporting documents for your records.

09

Submit the form as instructed. This may vary depending on the specific guidelines provided by the relevant authority or organization.

Who needs form 10u?

01

Form 10u may be required by individuals who are reporting their income, deductions, credits, and other relevant information to the tax authorities.

02

It is typically used for filing personal income tax returns by taxpayers who are not self-employed or do not have a complex tax situation.

03

The need for form 10u may vary depending on the jurisdiction and the specific requirements set forth by the tax authorities or other relevant entities. It is advisable to consult the appropriate guidelines or seek professional advice to determine if you need to fill out form 10u.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 10u?

Form 10-U is a filing form used by investment advisers to register with the Securities and Exchange Commission (SEC) in the United States. The form collects information about the investment adviser and its operations, including details about the adviser's ownership structure, services offered, compensation arrangements, and any potential conflicts of interest. By filing Form 10-U, investment advisers are required to provide transparency and accountability to the SEC and its regulations.

Who is required to file form 10u?

In the context of taxes in the United States, Form 10U is not a recognized IRS form. The designated form for individual income tax return filing is Form 1040. However, there might be specific circumstances or situations in certain states or localities where a form named 10U is required. To determine who is required to file such a form, it would be necessary to consult the specific regulations or requirements of the relevant tax jurisdiction.

How to fill out form 10u?

To fill out Form 10U, you will need to follow these steps:

1. Obtain a copy of Form 10U: You can either download it from the official website of the organization requiring the form or obtain a physical copy from their office.

2. Read the instructions: The form will typically come with a set of instructions that will guide you on how to properly fill it out. Make sure to read them carefully before proceeding.

3. Provide personal information: Start by providing your personal information such as your full name, address, phone number, email address, and social security number. This information is usually requested in the first section of the form.

4. Input organization details: If the form requires you to provide information related to an organization, fill in the required details such as the organization's name, address, and contact information.

5. Answer specific questions: The form may contain specific questions that you need to answer. These can be related to your qualifications, experience, education, or other relevant information. Carefully read each question and provide accurate and concise responses.

6. Include supporting documentation: Some forms may require you to attach supporting documents as evidence or verification. If this is the case, ensure that you gather all the necessary documents and securely attach them to the completed form.

7. Review and double-check: Before submitting the form, review all the information provided to ensure accuracy and completeness. Check for any errors or missing fields. It is crucial to double-check everything before submitting the form to avoid delays or potential issues.

8. Submit the form: Once you are satisfied with the completed form, submit it as per the instructions provided by the organization. This can be done electronically via email or an online portal, or by physically mailing the form to the designated address.

Remember to make a copy of the filled-out form for your records before submitting it, in case you need it for future reference.

What is the purpose of form 10u?

Form 10U is a filing with the Securities and Exchange Commission (SEC) that is used by certain eligible entities to provide notice of their status as exempt reporting advisers (ERAs). An ERA is an investment adviser that is exempt from SEC registration but is required to report certain information. The purpose of Form 10U is to formally notify the SEC of an entity's exemption and to provide basic information about the exempt reporting adviser. This form helps the SEC maintain regulatory oversight over ERAs and ensures transparency in the investment advisory industry.

What information must be reported on form 10u?

Form 10U is used to report a change in the information for a registered investment adviser (RIA) with the Securities and Exchange Commission (SEC). The specific information that must be reported on Form 10U includes:

1. Basic Identifying Information: The name, former name(s), and Central Index Key (CIK) number of the RIA.

2. Date of the Change: The date on which the change in information occurred.

3. Contact Information: The new address, phone number, and email address for the RIA.

4. Office Locations: Any changes to the RIA's principal office address, mailing address, or other office locations.

5. Website Address: The new website URL, if there have been any changes.

6. State Registration Information: Any changes to the RIA's registration information with the states in which it operates.

7. Non-Resident Clients: The number of non-resident clients as of the date of change.

8. Affiliated Entities: Information about any affiliated entities of the RIA, including changes in their names or addresses.

9. AUM (Assets Under Management): The RIA must report its total assets under management, as well as any changes to this figure.

10. Other Changes: Any other changes, including changes in control persons, contact persons, or the RIA's business activities.

It is important for RIAs to accurately report all necessary information on Form 10U to comply with regulatory requirements and keep their registration information up-to-date.

How can I manage my 10u form - ksrevenue directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign 10u form - ksrevenue and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I modify 10u form - ksrevenue without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including 10u form - ksrevenue. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit 10u form - ksrevenue in Chrome?

Install the pdfFiller Google Chrome Extension to edit 10u form - ksrevenue and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Fill out your 10u form - ksrevenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

10u Form - Ksrevenue is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.